by Amineddoleh & Associates LLC | Mar 23, 2024 |

In a highly-public withdrawal, Christie’s pulled four ancient Greek vases from auction. The four antiquities ranged in value from $7,000 to $30,000. It appears that the vases are the product of illicit dealings. They have been traced to the notorious antiquities trafficker Gianfranco Becchina.

One of the four disputed vases pulled from auction. Image via Christie’s.

Vases Traced to Notorious Dealer

Becchina, a well-known middleman in a looting network who was convicted for his actions in 2011, cosigned three of the four vases for a Geneva Christie’s auction in 1979. For the upcoming April 2024 auction, Christie’s listed the vases’ sale in 1979, but failed to disclose the fact that Becchina cosigned the objects. Dr. Christos Tsirogiannis, a lecturer at the Unviersity of Cambridge, called Christie’s nondisclosure “a trick used by the highest level. . . [t]hey deliberately exclude the connection of a trafficker in these three examples, although they’ve known about that connection for 45 years.”

Christie’s has released a statement counter to this effect, stating that the auction house “takes the subject of provenance research very seriously, especially when it related to cultural property.” However, taking the subject of provenance research seriously, and proactively allocating the resources and dedicated staff to carry out the work, are two different things.

A disputed vase pulled from auction. Image via Christie’s.

New Head of Provenance at the Met

In other antiquities news, the Metropolitan Museum of Art is taking a proactive stance. Last month, the museum hired Lucian Simmons (previously of Sotheby’s) as its first-ever Head of Provenance Research. This new position points to the museum’s recent efforts to increase the museum’s number of provenance-specific employees, in an era of greater scrutiny against both private and public collections. An increase in the number of restitutions has occurred during the past few decades, and this new hire makes the Met better situated to research provenance issues and handle requests for restitution. Mr. Simmons’ hiring brings the number of specialized province employees to eleven – an astonishing number for the institution.

Mr. Lucian Simmons. Image via Wilson Santiago/Metropolitan Museum of Art.

Mr. Simmons has extensive experience with provenance research and related issues, due to his long tenure at Sotheby’s. Since 1997, Simmons has developed and deployed transparent provenance policies for the auction house. In fact, transparency is at the heart of all of Simmons’ provenance work. He told to The New York Times that from the beginning of his time at Sotheby’s, he has “always tried to make sure [Sotheby’s was] very open” in the provenance research processes. Simmons intends to continue innovative model of transparency when he transitions to the Met this coming May.

New Awareness for Repatriation of Looted Antiquities

Repatriation actions for looted antiquities are increasingly being brought by countries around the world. Our firm has proudly represented and won legal claims related to looted antiquities on behalf of several nations, including the Republic of Italy and the Hellenic Republic of Greece. The cultural shift towards an increased awareness and respect for repatriation and restitution claims is something our firm both applauds and works to uphold.

by Amineddoleh & Associates LLC | Mar 5, 2024 |

In honor of International Women’s Day and Women’s History Month, our firm is reposting one of our favorite blog posts. This post originally ran on our firm’s blog in 2021.

—

It is a bitter truth that women, who are so often depicted, admired and romanticized through art, have had to overcome herculean obstacles to participate in its creation. In honor of Women’s History Month, this entry in our Provenance Series examines the work of the Old Masters’ female counterparts – the Old Mistresses – and their contemporary successors.

Rediscovery of Female Artists

Renaissance and Baroque works by women have deservedly entered the public consciousness in recent years. In 2019, a depiction of the Last Supper by nun Plautilla Nelli was installed in the Santa Maria Novella Museum in Florence, after a painstaking 4-year restoration by the Advancing Women Artists Foundation (AWA). The project was made possible through the AWA’s “adopt an apostle” crowdsourcing program: private financiers were allowed to “adopt” one of the life-sized disciples at $10,000 each (ever-unpopular Judas was instead funded by 10 backers at only $1,000 each). The oil painting, measuring 21 feet across, is one of the largest Renaissance works by a female artist still in existence. It is also the only work created by a woman during the Renaissance depicting the Last Supper.

Last Supper by Plautilla Nelli (prior to restoration). Image via My Modern Met.

The Provenance and Restoration of Plautilla Nelli’s The Last Supper

The Last Supper was likely created for the benefit of Plautilla’s own convent, the convent of Santa Caterina di Cafaggio in Florence, where it hung in the refectory (dining hall) until the Napoleonic suppression in the 19th century, when the convent was dissolved. It was thereafter acquired by the Florentine Monastery of Santa Maria Novella in 1817. Again, it was housed in the refectory until being moved to a new location in 1865. Scholar Giovanna Pierattini reports it was moved to storage in 1911, where it remained until 1939. It then underwent significant restoration, and returned to the refectory. It would remain on display there for almost forty years, surviving the historic flood of the Arno in 1966 with little damage. The work was next taken down in 1982, when the refectory was reclassified as the Santa Maria Novella Museum, and transferred to the friars’ private rooms. This is how the monumental work, which remained out of the public eye for centuries, is now visible to the public for the first time in 450 years.

Rossella Lari, the restoration’s head conservator remarks, “We restored the canvas and, while doing so, rediscovered Nelli’s story and her personality. She had powerful brushstrokes and loaded her brushes with paint.” The painting features emotionally charged expressions, emphatic body language, and exquisite details, such as the inclusion of customary Tuscan cuisine (roasted lamb and fava beans).

Santa Maria Novella in Florence, Italy. Image courtesy of CAHKT/iStock.com.

Plautilla’s use of color and composition is even more impressive when one considers that women were barred from attending art schools and studying the male nude; instead, they were forced to rely on printed manuals and the works of other artists. Plautilla was not only a self-taught artist, but she also ran an all-woman workshop in her convent and received the ultimate praise for an Italian Renaissance painter: inclusion in Giorgio Vasari’s seminal book Lives of the Most Excellent Painters, Sculptors and Architects. Notably, in Plautilla’s time the convent was managed by Dominican friars previously under the leadership of fire-and-brimstone preacher Girolamo Savonarola. The nuns were encouraged to paint devotional pictures in order to ward off sloth.

Undeterred, “Plautilla knew what she wanted and had control enough of her craft to achieve it,” says Lari. The Last Supper is signed “Sister Plautilla – Orate pro pictora” (“pray for the paintress”). Plautilla thus confirmed her role as an artist while acknowledging her gender, understanding that the two were not mutually exclusive. Although only a handful of the works survive today, Plautilla and her disciples created dozens of large-scale paintings, wood lunettes, book illustrations, and drawings with great focus, determination, and discipline. She is considered the first true woman artist in Florence and in her heyday, “There were so many of her paintings in the houses of gentlemen in Florence, it would be tedious to mention them all.” Since AWA’s conservation work was initiated, the number of works attributed to Plautilla has risen from three to twenty, meaning that other undiscovered masterpieces could be lying in wait.

Female-Led Museum Exhibitions

The Prado Museum in Madrid has hosted an exhibition featuring two overlooked Baroque painters, Sofonisba Anguissola and Lavinia Fontana, in an exhibition entitled “A Tale of Two Women Painters.” Meanwhile, the National Gallery in London hosted a show dedicated to Artemisia Gentileschi. Notably, Sofonisba, Lavinia and Artemisia all achieved fame and renown during their lifetimes, including royal commissions, only to be eclipsed for centuries after their deaths. Sofonisba was particularly sought after for her ability to capture the expressiveness of children and adolescents in intimate portraits, while Lavinia’s commissions displayed a more formal Mannerist style. Artemisia, the subject of the National Gallery’s first major solo show dedicated to the artist, is recognized as much for the strength of her figures in chiaroscuro as for her life story involving sexual assault and trial by torture. Despite considerable difficulties, Artemisia was able to succeed in a male-dominated field and created over 60 works, most of which feature women in positions of power. Artemisia is now hailed as one of the most important painters of her generation and an established Old Mistress in her own right.

Female Artists at Auction

Despite their long slumber in the annals of history, these artists are not only receiving attention in museums, but in auctions as well. In 2019, a painting by Artemisia depicting Roman noblewoman Lucretia shattered records when it sold for more than six times its estimated price at Artcurial in Paris. While estimates originally placed the work at $770,000 to $1 million, the painting was ultimately acquired by a private collector for $6.1 million. Lucretia was discovered in a private art collection in Lyon after remaining unrecognized for 40 years. It was in an “exceptional” state of conservation according to Eric Turquin, an art expert specializing in Old Master paintings previously at Sotheby’s.

Artemisia Gentileschi’s Lucretia (ca. 1630-1640). Image via Getty Museum.

The earlier record for one of Artemisia’s works had been set in 2017, when a painting depicting Saint Catherine sold for $3.6 million. That painting, a self-portrait of the artist, was then acquired by the National Gallery in London for $4.7 million in 2018. This was the first painting by a female artist acquired by the National Gallery since 1991, and the 21st such item in its entire collection, which encompasses thousands of objects. Saint Catherine had been owned by a French family for decades, but its authorship was obscured prior to its rediscovery and sale by auctioneer Christophe Joron-Derem. The painting was acquired by the Boudeville family in the 1930s, but the exact circumstances of this acquisition and the painting’s prior whereabouts were unclear. At the time of the National Gallery’s purchase, museum trustees raised concerns that the work might have been looted during World War II, although there is no firm evidence to support this suspicion. Despite the gaps in the works’ provenance, it was ultimately determined that the painting had been with the family for several generations and Saint Catherine was welcomed to her new home in London.

Recent Attributions

More recently, a painting of David and Goliath was attributed to Artemisia after a conservation studio in London removed layers of dirt, varnish and overpainting to reveal her signature on David’s sword. While the work’s attribution occurred too late for inclusion in the National Gallery exhibition, the owner is apparently delighted to discover the work’s true author and is keen to loan it to an art institution so the public can enjoy the work. This painting was originally acquired at auction for $113,000 and may have been owned by King Charles I – quite an esteemed pedigree and sure to raise its value by a considerable amount.

Artemisia Gentileschi, David and Goliath. Image courtesy of Simon Gillespie Studio.

In contrast to Artemisia’s ascendance, a painting once attributed to her father Orazio Gentileschi is now embroiled in controversy. That painting, which also depicts David and Goliath and described as “stunning” by the Artemisia show curator, has links to notorious French dealer Giuliano Ruffini. Ruffini is the subject of an arrest warrant due to his connection with a high-profile Old Master forgery ring operating in Europe. It is believed that the forgery ring, uncovered in 2016, garnered $255 million in sales, including works represented as being by Lucas Cranach the Elder and Parmigianino.

Although these paintings were widely accepted as genuine masterpieces and fooled leading specialists, they did not have verifiable provenances. The paintings were said to belong to private collector André Borie, although that was not the case and Sotheby’s was forced to refund money to buyers once the fraud came to light. The Gentileschi in question had been “discovered” in 2012 and sold to a private collector, who loaned it to the National Gallery in London. At that time, the painting was praised for its “remarkable” lapis lazuli background, but the museum did not conduct a technical analysis before displaying the piece. Despite several warning signs – the painting’s recent entrance into the art market, its unusual material, its similarity to another Gentileschi painting held in Berlin, and the lack of published provenance – the museum stated that there were “no obvious reasons to doubt” the painting’s attribution.

The forgotten nature of some female artists demonstrates that their talents are not rare, but rather that they lack the opportunities and publicity that male artists often take for granted. Once their talent is amplified, female artists are capable of great things. This pattern continues today.

The Modern Struggles of Female Artists

As famous female artists lost to history capture the public eye, they are joined by female contemporaries who share a similar struggle against underrepresentation. Women’s contribution to modern and contemporary art is often exemplifiedby those with ties to established male artists: Mary Cassatt (who achieved recognition as an Impressionist in Paris through her relationship with Edgar Degas); Georgia O’Keeffe (who entered the public eye via her relationship to Alfred Stieglitz); and Frida Kahlo (introduced to the art world by her husband, Diego Rivera). This truncated view ignores the vast amount of creative output generated by women, and reinforces the notion that recognition must be made through a male lens, a view prevalent during Artemisia’s time. It is worth noting that Artemisia’s father Orazio Gentileschi was her teacher and facilitator in the Baroque art market. In fact, this attitude has denied countless female artists of their deserving places in the canon of art history. It has even enabled surreptitious artists to take credit for works by others.

Yayoi Kusama.

Image courtesy of Kirsty Wigglesworth.

Today, Yayoi Kusama is a household name. The world’s top-selling female artist, she is renowned for her peculiar polka-dotted paintings and sculptures, which command long lines at preeminent art institutions across the globe. Like many famous contemporary artists from the last century, she is strongly associated with a unique personal style, and recognized by her bright-red wig. Despite her phenomenal success, her position in the pantheon of notable contemporary artists was anything but assured. Born in the rural town of Matsumoto, Japan in 1929, Kusama was discouraged from pursuing a career; rather, she was encouraged to marry and start a family. Frustrated by the constant efforts to suppress her artistic aspirations, she wrote to the already famous Frida Kahlo for advice. Kahlo warned that she would not find an easy career in the US, but nevertheless urged Kusama to make the trip and present her work to as many interested parties as possible.

Unsurprisingly, Kahlo’s advice was accurate. After traveling to New York, Kusama’s early work received praise from notable artists Donald Judd and Frank Stella, but it failed to achieve commercial success. Her work also attracted the attention of other renowned artists, who were able to channel ‘inspiration’ from Kusama’s work right back into the male-dominated New York art market. Sculptor Claes Oldenburg followed a fabric phallic couch created by Kusama with his own soft sculpture, receiving world acclaim. Andy Warhol repurposed her idea of repetitious use of the same image in a single exhibit for his Cow Wallpaper. Most blatantly, after exhibiting the world’s first mirrored room at the Castellane Gallery, Lucas Samaras exhibited his own mirrored exhibition at the Pace Gallery only months later. Needless to say, these artists did not credit Kusama for her work and originality. This ultimately caused a despondent Kusama to abandon New York and return to Japan.

Kusama spent the next several decades largely in obscurity. The frustrations in her career resulted in multiple suicide attempts and long-term hospitalizations. However, Kusama always found a way to channel this energy back into her art, and she continued to create art in various formats as a way to heal. It was not until a 1989 retrospective of her work in New York and an exhibition at the 1993 Venice Biennale that the world truly tok notice of her work. This global reintroduction was enough to galvanize interest in her artistic creation, leading to the success she enjoys today. While it may seem just that such a talented artist would eventually receive recognition for her work, this is not always a given and Kusama’s near erasure from the art world should not be discounted.

The Gendered Art Market Divide

In today’s art market, artists, collectors, dealers, and museums are making a concerted effort to fight this type of erasure. Kusama stands as a beacon to others, demonstrating that female artists can reach the pinnacle of their profession. However, it remains an arduous career path for many. Statistical analysis confirms that female artists are underpaid and underrepresented in both the primary and secondary art markets. For example, compare the highest price paid for a work by a living artist by gender: Jeff Koons’ Rabbit sold for $91.1 million in 2019; while Jenny Saville’s Propped sold for $12.5 million that same year, a mere 14% of the Koons’ price. Some of this disparity can be explained by the difference between men and women’s treatment in the workplace generally, but the art world is also subject to a number of particularities. Attributed to a host of causes, perhaps none is more prominent than women’s almost total exclusion from studio art until the 1870s. The art world has existed in this environment for so long that its institutions and relationships now mechanically reinforce the disparity between genders: women are less likely to receive recognition and training, and buyers are less interested in art created by females. The interest in female-made art is also disproportionality concentrated on its biggest names; the top five best-selling women in art held 40% of the market for works by women auctioned between 2008 and 2019. It has become a self-sustaining cycle that can only be broken through deliberate and effective action.

Initiatives Supporting Female Artists

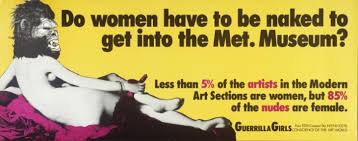

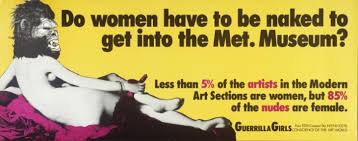

Artists and galleries have been working to shine a light on the current landscape of inequality in the market. Groups like the Guerilla Girls have used their cultural status and notoriety to vocalize issues regarding sexism, racism, and other types of discrimination still rampant today. This type of radical-meets-reformer message resonates with a newer generation that is more vocal about addressing discrimination, and frustrated by the seemingly lackluster efforts to minimize their impact on society. In honor of Women’s History Month, several galleries have announced shows dedicated to addressing some of these issues. The Equity Gallery is presenting “FemiNest,” a collection of works by female artists centered around the literal and metaphorical ideas conjured by the idea of a “nest.” The show explores in sculpture, textiles, painting and other media the new spaces that have opened for women in recent decades and their practical and spiritual impact for women. The Brooklyn Museum has announced a retrospective of Marilyn Minter’s work titled “Pretty/Dirty” aimed at challenging traditional notions of feminine beauty. Featuring more than three decades of work, the show will track Minter’s progress throughout the 1970s, 80s, and 90s. The show is also part of a larger series of ten exhibitions by the Brooklyn Museum dedicated to the subject: “A Year of Yes: Reimagining Feminism at the Brooklyn Museum.” Lastly, the Zimmerli Art Museum will feature an exhibition of works by the Guerilla Girls and other female artists who have worked to depict women’s unequal treatment in the art world, “Guerrilla (And Other) Girls: Art/Activism/Attitude.” (For more information about these shows and others addressing similar issues, see here.)

Do Women Have To Be Naked To Get Into the Met. Museum? (1989), Guerrilla Girls. Image via the Met.

Although artists and art institutions have just begun the work of winding back centuries of discrimination, there is evidence that their work is already affecting the market. The percentage of female-generated artwork in the secondary market is increasing from year to year; from 2008 to 2018, the market more than doubled from $230 million to $595 million. Similarly, representation of women at major art shows is steadily, if inconsistently, increasing as well. This subtle shift in the market has been attributed at least in part to a new class of art purchaser: independently wealthy women, whose capital is self-made rather than inherited or shared via marriage. This novel source of demand is less sensitive to the traditional pressures of the market and is helping to fuel demand for works by female artists. Women’s History Month is an opportunity to reflect on the tremendous progress made by remarkable individuals in the art world, and to also contemplate the ripe opportunities that still lie ahead.

by Amineddoleh & Associates LLC | Feb 20, 2024 |

The Biden-Harris administration released Executive Order on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence on Oct 30, 2023. The order directs governmental agencies to use eight policies and principles (listed on the left) to drive responsible AI use and development. Additionally, the order creates opportunities for private organizations, members of academia, international allies, and civil society to voluntarily adopt these principles.

Artwork from Refik Anadol’s exhibition Unsupervised. Anadol used artificial intelligence to interpret and transform more than 200 years of art at MoMA. Image via MoMA.

“AI” Defined

The order defines “artificial intelligence” or “AI” as “a machine-based system that can, for a given set of human-defined objectives, make predictions, recommendations, or decisions influencing real or virtual environments.” 15 U.S.C. 9401(3). This is a purposefully broad definition of AI and is not limited to generative AI systems.

AI-generated cubist artwork. Subversive Pink by Abstrix. Image via artaigallery.com.

Policies & Principles

The order directs governmental agencies to use eight policies and principles to drive AI use and development. These policies and principles are:

- Ensuring new standards for AI safety and security

- Protecting privacy

- Advancing equity and civil rights

- Standing up for consumers, patients, and students

- Supporting workers

- Promoting innovation and competition

- Advancing international cooperation

- Advancing the responsible and effective federal government use of AI

AI-generated floral artwork. Deadly Seaweeds by Latebloomr. Image via artaigallery.com.

The Basics

Recurring themes in the order are transparency and responsibility. The directive repeatedly instructs organizations to regularly evaluate their existing AI-related risks, develop organizational AI-management practices, and promote disclosure and transparency procedures across sectors. The directive also suggests that all users, developers, and vendors of AI-enabled technology be prepared for forthcoming AI-related guidance and legislation from federal agencies, state and local governments, and federal legislative bodies.

AI assistants are trending. Rabbit personal AI-powered companion. Image via rabbit.tech.

To Whom Does the Order Apply?

At present, the order is binding on federal agencies (with the exception of independent agencies). However, the order addresses AI risks and benefits at all stages of the AI-supply chain: development, procurement, and deployment. As a result, any private sector organization that does business with a federal agency should adhere to the order’s policies and principles. Organizations that are not directly impacted may still want to adhere to the policies and principles. Future AI governance will be informed by the evolving industry standards and best practices. Those who voluntarily abide by these policies and principles will have an advantage against those who are not proactive when new laws are not proactive when new laws are inevitably passed.

AI-generated cubist artwork. Finite Maze by Abstrix. Image via artaigallery.com.

Takeaways

This landmark order establishes new standards for AI safety and security. It aims to harness the promise of AI, while mitigating its risks to privacy and equity and civil rights.

As AI systems continue to be developed and introduced into the stream of commerce, the industry standards that evolve from this order will likely also apply to private organizations that incorporate AI or use third-party vendors’ AI-enabled services. These services may take the form of services used to aid in business, administration, hiring, and/or marketing purposes. As an example, cultural institutions should anticipate forthcoming AI-enabled services to include curation, record-keeping, artist exhibitions, and to aid in visitor engagement and experience.

To ensure your organization is in compliance with these policies and principles, consider a consultation with our firm.

For a printable fact sheet, click here.

by Amineddoleh & Associates LLC | Feb 13, 2024 |

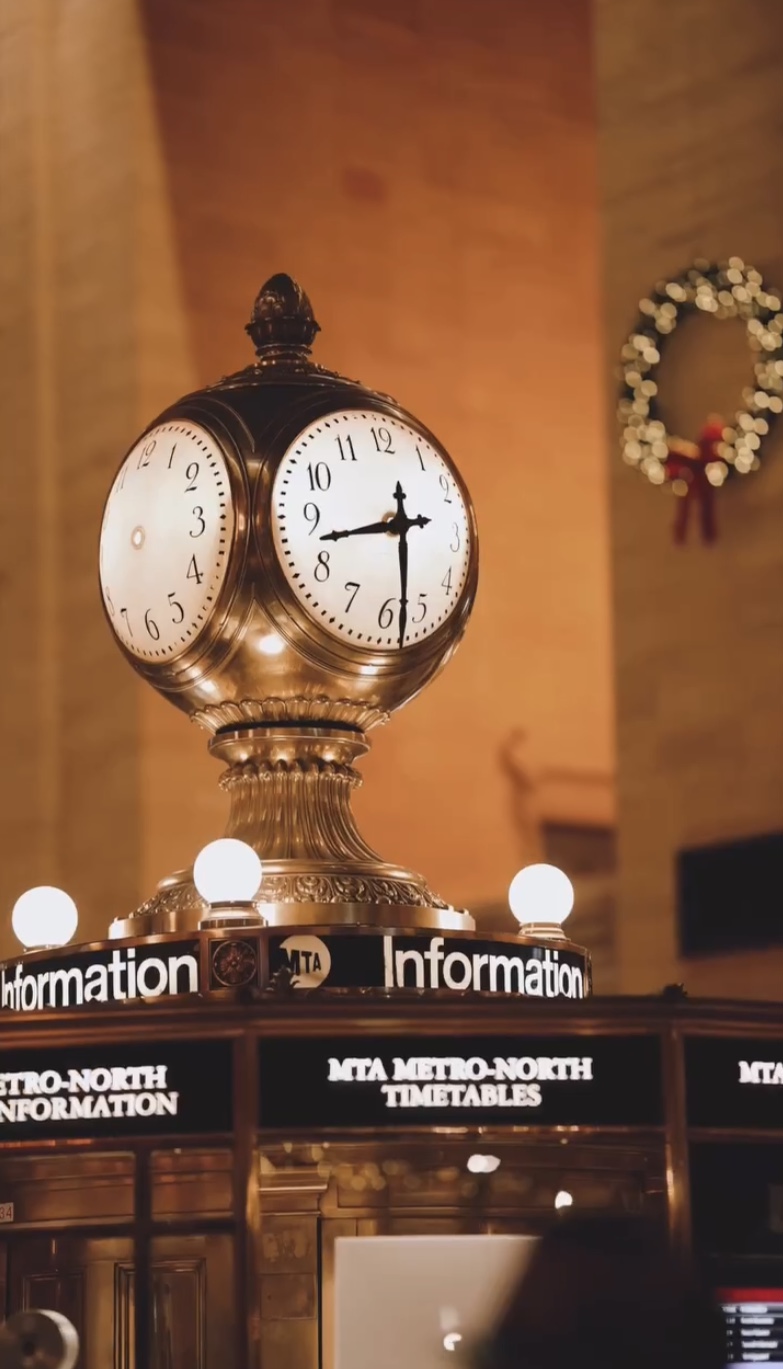

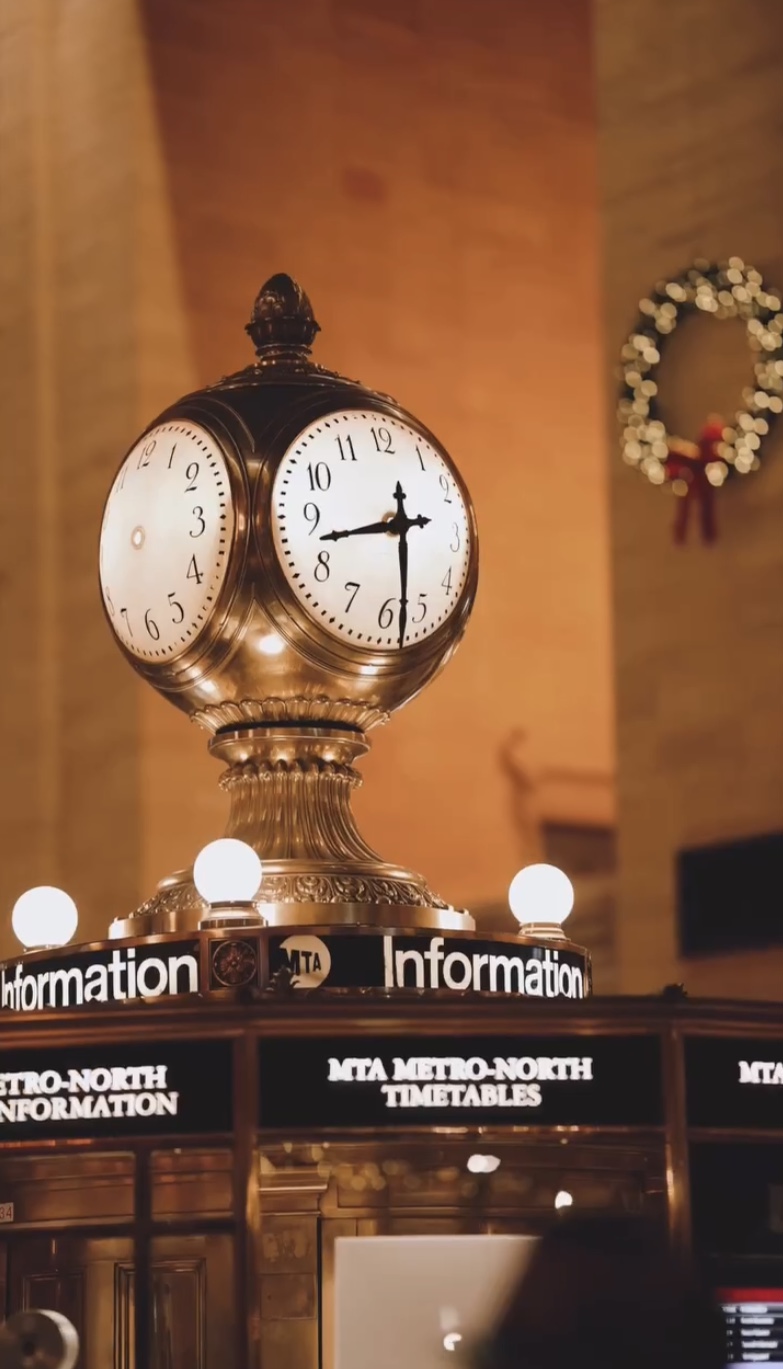

For most New Yorkers, the words “Grand Central” may not evoke feelings of romance. However, this historical terminal is more charming than it appears. One of its most endearing hidden gems is a tiny alcove meant to give couples a place to meet up – and share a romantic kiss – after long-distance travel.

Grand Central Terminal. Image via Jakun Halun.

The Kissing Gallery

The Kissing Gallery at Grand Central Terminal, located inside the Biltmore Room, is the place to be this Valentine’s Day. The Kissing Gallery is what it sounds like – a snug alcove in the Biltmore Room, tucked away in largest railroad station in the world, and specifically designed for kissing. It is the place for lovers to steal away from the crowd for a kiss.

The Biltmore Room in Grand Central. Image via gothamist.com.

(Psst..did you know? Grand Central Terminal refers to the terminal line, which means trains stop at Grand Central Terminal. Grand Central Station refers to the subway station inside GCT. Those subway lines pass through GCT).

The origins of the Kissing Gallery date back to Grand Central Terminal’s (GCT’s) earliest days. When GCT opened in 1913, it was a much more organized animal than the spastic craziness modern commuters encounter today. In the beginning, the terminal was carefully planned and designed to facilitate the flow of both long-distance and short-distance travelers.

Early in its operation, staff noticed that foot traffic was constantly jammed in areas where long-distance trains emptied out. The problem? Lovers’ reunions were causing literal standstills on pedestrian walkways.

It’s an adorable slice of New York City history: kissing caused traffic jams, so city dwellers devised an imaginative solution. This solution was simple: create a special room solely for kissing.

Shockingly, this worked, and meeting up in the Kissing Gallery post-transit with a special someone was considered the norm. Traffic jams caused by kissing all but stopped. (Nowadays, pedestrian traffic hold-ups are due to the invasion of the selfie takers. Unless, of course, the hold-up takes place on the field after Super Bowl LVII. Then, foot traffic has stopped to make way for Taylor Swift and Travis Kelce’s showstopping, celebratory kiss).

The Biltmore Room in the 1950’s. Image via Boris Klapwald.

Even so, a public kissing room was a bit racy for the 1910s. To alleviate any possible discomfort among other travelers, a few ground rules were instituted. The two major regulations were (1) each kiss may last a maximum of five seconds, and (2) absolutely no tongue.

(These rules were actually written in the manual and were readily enforced by GCT staff).

It’s a cute story – The Kissing Gallery, with history that stretches back nearly 120 years, is one of the many secrets and surprises of GCT that have been preserved. GCT’s preservation is due to historic preservation laws – and a major Supreme Court case.

Penn Central Transp. Co. v. New York City (1978)

In the late 1970s, Penn Central (the business owners of GCT) began to make plans for a major renovation to the terminal. Penn Central hoped to install a 50-foot skyscraper atop the historic building. From a business perspective, such an ugly installation made sense. From an aesthetic perspective, it was madness. Thankfully, New York City prevented Penn Central from starting the job. In response, Penn Central sued, arguing that the City’s refusal to let the project go forward amounted to an unconstitutional taking.

A bitter legal battle ensued, and eventually made its way to nation’s highest court. Penn Central’s primary argument for the construction was their company’s bottom line. Penn Central argued economic hardship, should the terminal continue to be run in its present condition. The company also showed the Court accounting documents to demonstrate how much more profitable the terminal would be under the proposed changes. However, the financials alone were not enough to convince the Court.

The Court acknowledged that the proposed transformation would increase the company’s bottom line. But, the Court said, GCT was making Penn Central a considerable profit as it was. Moreover, GCT was already legally a historic building under the Landmarks Act. This was not the determinative factor in the Court’s ultimate decision, but the justices took it into account. The Court said that Penn Central should not have reasonably expected to be able to initiate such a dramatic construction project anyway, because GCT had already been given historic designation under the Landmarks Act.

Grand Central Terminal. Image courtesy of NannFilms, used with permission.

Finally, the Court pointed out that the restrictions that come with owning a historic landmark may seem burdensome, Penn Central also benefitted from the restrictions placed on neighboring properties that prevented certain land use changes. And then (to make matters worse for Penn Central), it turned out that the accounting documents (provided by Penn Central to show economic hardship) were misleading, and did not give an accurate depiction of the company’s profits and losses (whoops).

In the end, the Supreme Court ruled in favor of the City, and stopped Penn Central from breaking ground on their renovation – a decision that buoyed the hearts and souls of art and cultural heritage experts around the world. Not only that, many notable New Yorkers (including a one Jackie O.) were against the destruction of such an important piece of New York City history. Possibly even judges on the Supreme Court were not immune to her charms.

Grand Central School of Art

The Kissing Gallery is not the only romantic secret hidden within the Grand Central Terminal.

A little-known fact about Grand Central is that the seventh floor of the East Terminal once housed the Grand Central School of Art. This was an art school in New York City with instructors who taught skills across artistic disciplines, including sculpture, mural painting, illustration, and costume design.

The Betrothal II by Arshile Gorky (1947). Image via oceansbridge.com.

The Grand Central School of Art (not to be confused with the modern-day Grand Central Academy of Art, which is a wonderful art school on Long Island), was one of the largest and most prominent art schools in the city at its prime. The school’s success (and notable alumni) befits the institution’s illustrious founders: Edmund Grecean, Walter Leighton, and John Singer Sargent.

Who would have thought that John Singer Sargent had the time and energy to open a prestigious art school, on top of all his notable commissions for fancy socialites? In any event, he did, and he and Grecean used their art world connections to bolster an impressive faculty: Chester Beach (sculptor), Ezra Winter (muralist), Dean Cornwell (muralist), Helen Dryden (illustrator and costumer designer) and Arshile Gorky (painter), to name a few.

The school enjoyed a good 20-year history before things turned south. After a grand opening in 1923, the Grand Central School of Art sadly shuttered its doors in 1944 due to financial difficulties.

Even after the school closed, artists from around the world used the vibrant energy of Grand Central Terminal in their work. Something about the fast-paced movement, the glorious architecture, and the joyous lovers reunions must prompt artists to capture the moment with great creative aplomb.

Not convinced? Check out The Kiss by Ernst Hast (1958). The featured couple appears to be truly in love, and also seems to be breaking a few important Terminal rules.

The Kiss by Ernst Hast (1958). Image via icp.org.

The Kissing Gallery is in the Biltmore Room, folks!

by Amineddoleh & Associates LLC | Jan 30, 2024 |

Nu Couché au coussin Bleu by Modigliani. Image via Artsy.

For years, the art world watched the dispute between Russian oligarch Dimitry Rybolovlev and Swiss shipper-turned-dealer Yves Bouvier. While their relationship’s start seemed fruitful and equally beneficial as it led to Rybolovlev’s acquisition of some of the most highly sought-after art treasures, the tide turned when the Russian billionaire discovered that Bouvier had been dishonest about information related to arts sales. Rybolovlev began a legal battle, engaging in scorched earth tactics to pursue claims against Bouvier in jurisdictions around the world. With allegations by a billionaire collector against one of the art world’s best known freeport owners and lavish dealers, many players in the art world were swept up in the fight.

At the heart of the dispute is whether Bouvier committed fraud and breached a fiduciary duty to Rybolovlev. The Russian collector alleges Bouvier flipped high-end artworks that he significantly marked up, although Bouvier represented to Rybolovlev that he was only making a 2% commission on the sales. In some instances, Bouvier concealed the fact that he or one of his shell companies had purchased the artwork shortly before selling it to Rybolovlev. The Russian billionaire alleges this was fraudulent. In addition, the collector argues that Bouvier breached his fiduciary duty because he was the seller, despite Rybolovlev’s belief that Bouvier was serving as his agent and advisor, not as a party with an ownership interest. Bouvier argues he was not Rybolovlev’s agent or advisor. The bounds of the relationship are not clear.

A scorned Rybolovlev filed charges about Bouvier in numerous countries. Eventually, Bouvier was arrested on criminal charges in Monaco in 2015 but was released. Equally salacious were Rybolovlev’s attempts to have authorities prosecute Bouvier, leading to claims that the Russian collector bribed law enforcement to pursue the case against Bouvier. It became known as “Monaco-gate.”

Eventually, Rybolovlev’s legal claims against Bouvier were either dismissed or settled, with the last one settled in December 2023 over claims filed in the United States. However, Rybolovlev felt wronged and thought others were complicit in supporting Bouvier’s fraud, and thus outstanding legal issues remained concerning other parties that were allegedly part of a fraud orchestrated by Bouvier. As Sotheby’s worked with Bouvier to conduct private sales to the collector, Rybolovlev sued one of the world’s leading auction houses in the Southern District of N.Y. (Accent Delight Int’l v. Sotheby’s, 18-CV-9011 (JMF) (S.D.N.Y. Nov. 21, 2023). The highly anticipated trial began during the second week of 2024. Closing arguments took place on Monday with the jury deciding the verdict in under 6 hours on Tuesday, January 30.

One of the works Rybololev purchased. Tête by Modigliani. Image via Sotheby’s.com.

WHAT WERE THE ALLEGATIONS AGAINST SOTHEBY’S?

Rybolovlev sought $377 million in damages from Sotheby’s, alleging that the famed auction house was complicit in Bouvier’s scheme. He argued that he relied on documents from Sotheby’s when making lavish purchases of blue-chip artworks. Rybolovlev alleged that Sotheby’s and Sotheby’s, Inc. (together, “Sotheby’s”) aided and abetted Bouvier in committing fraud. The complaint reads:

“Sotheby’s gave Bouvier written materials designed to induce Plaintiffs to pay inflated, fraudulent prices. After transactions, Sotheby’s lent a veneer of legitimacy and expertise to those fraudulent prices by providing Bouvier with inflated appraisals on demand. Sotheby’s intentionally omitted the sales to Bouvier from the transaction histories listed in these appraisals. In short, Sotheby’s assisted Bouvier in acquiring artworks at prices the sellers were willing to accept while helping him charge Plaintiffs fraudulently inflated prices (and concealing the actual acquisition prices from Plaintiffs).”

To successfully prove that Sotheby’s aided and abetted in the commission of fraud, Rybolovlev would have had to prove: “(1) the existence of an underlying fraud; (2) knowledge of the fraud on the part of the aider and abettor [in this case, Sotheby’s]; and (3) substantial assistance by the aider and abettor in achievement of the fraud. Many federal New York courts additionally consider whether the alleged “assistance” constitutes the proximate cause of the damage. “But-for” cause may be insufficient. See, Pension Comm. of Univ. of Montreal Pension Plan v Banc of Am. Sec., LLC, 446 F. Supp. 2d 163, 201-02 (S.D.N.Y. 2006) (“aider and abettor liability requires the injury to be a direct or reasonably foreseeable result of the conduct.”).

While Sotheby’s filings did not deny that Bouvier committed fraud, the auction house addressed allegations against it. As in any legal matter involving claims of fraud, it is a hurdle proving that someone had actual knowledge about a fraud. (This is what Ann Friedman argued in the Knoedler Gallery scandal—she claimed that she did not know that the forgeries sold through the gallery were not authentic.) As predicted, Sotheby’s denied knowledge of, and participation in, any scheme by Bouvier. As I told many reporters during the trial, I expected that Sotheby’s would not be found guilty for this reason– proving knowledge is a challenge.

On Jan. 30th, 2024, the New York jury cleared Sotheby’s of the allegations. The jury deliberated for six hours before releasing their verdict, and found in favor of Sotheby’s on four claims. This has the potential to put an end to the decade-long battle that stems from activity between Rybolovlev and Bouvier.

WHY WAS THIS CASE SO IMPORTANT?

The allegations in this case were not that particularly shocking because accusations of fraud are common, especially because fraud often occurs in the market. The art market is full of forgeries, price-escalation schemes, unnamed middlemen, collectors who do not conduct due diligence, and parties that do not disclose their interests in artworks for sale. But what is special about this case is that the public gets a glimpse into the rarefied world of art collectors and the uber-wealthy.

Christ as Salvator Mundi by Leonardo DaVinci. Image via Financial Times.

WHAT WAS NOT SURPRISING?

It was surprising that Bouvier thought Rybolovlev would not learn about the major markups. Rybolovlev first began to suspect he was being swindled in 2014 – a good twelve years after he and Bouvier began their dealer-purchaser relationship. It is astonishing that Bouvier kept his activity secret for as long as he did, because, in those dozen years, Rybolovlev was mixing with major players in the art world and art media at large – in both formal and informal settings.

In 2014, Rybolovlev read a N.Y. Times article that reported the price of Christ as Salvator Mundi (from the 2013 Sotheby’s private sale) to have been between $75-80 million. Enraged, Rybolovlev contacted Bouvier, who dismissed the Times’ reporting as a mistake. He stated that the media’s price was faulty, and that it did not include fees and commission. Rybolovlev was not convinced. Bouvier – panicked – reached out to Sotheby’s to get an appraisal. The ensuing appraisal (made in January 2015) marks the work’s value at $100 million. However, the named price seems to have been prompted by an email from Bouvier, which requests this $100 million evaluation. It further omitted the 2013 sale of the work to Bouvier (which Sotheby’s brokered).

Even so, from Rybolovlev’s perspective, this appraisal from such a storied and knowledgeable institution could have seemed legit. Bouvier’s subterfuge may have continued to work for another twelve years. However, Rybolovlev was too well connected in the art world for this to continue. While Bouvier scrambled to have the Salvator Mundi appraised, Rybolovlev got his next clue over a casual lunch with a friend in St. Barts in late 2014. Because of Rybolovlev’s connections, it came as no surprise that his lunch partner was an experienced art advisor. The N.Y. Times reports that Rybolovlev was enjoying a casual lunch with his art advisor friend at the Eden Rock hotel on St. Barts when he learned the true price of a Modigliani painting (likely Nu Couche au Coussin Bleu).

With the art world being so small, it is not surprising that Bouvier’s scheme was uncovered. It was only a matter of time before the constant chatter in the art world eventually led to the dissolution of their relationship and to a bitter feud involving hundreds of millions of dollars and featuring the bluest of the blue-chip artists in the high-stakes art world. There are few collectors with the funds to acquire works at such astronomical prices, and even though parties often remain anonymous, it was inevitable that word would get back to Rybolovlev that he was suckered out of hundreds of millions of dollars.

WHAT WAS SHOCKING?

The mere fact that the billionaire sued Bouvier in several jurisdictions around the world, and then pursued Sotheby’s, is actually the most shocking part of this ordeal. Rarely are private and uber-wealthy collectors willing to disclose so much about their personal dealings and friendships. When parties engage in litigation, information is disclosed, and the public is eager to learn more about the dealings of both Rybolovlev and Sotheby’s.

WHAT DOES THIS SAY ABOUT THE MARKET FOR ART AND ANTIQUITIES?

The art and antiquities market is notorious for being opaque. Anonymity is protected for many reasons, many of which are legitimate. The NY Times traces the secrecy in the market to 15 and 16h century Europe “when the Guilds of St. Luke, professional trade organizations, began to regulate the production and sale of art in Europe. Until then, art was not so much sold as commissioned by aristocratic or clerical patrons. But as a merchant class expanded, so did an art market, operating from workshops and public stalls in cities like Antwerp. To thwart competitors, it made sense to conceal the identity of one’s clients so they could not be stolen, or to keep secret what they charged one customer so they could charge another client a different price, incentives to guard information that persist today.”

However, the lack of information causes major problems because market participants cannot make rational decisions about purchases. The lack of information also leads to challenges completing due diligence, confirming title, navigating the authentication process, preventing money-laundering, and even understanding where artworks go after disputes are resolved (like divorces or business dissolutions). And as we’ve seen in the most recent litigation, it’s not possible to follow the money and determine who is profiting from transactions. Here, Rybolovlev did not know that Bouvier was an interested party with an ownership interest—that lack of knowledge led the collector to trust Bouvier. Rybolovlev did not know that Bouvier was acting against his interests and not on his behalf. While Rybolovlev thought Bouvier was his agent, he was actually the party on the other side of the negotiations.

As Rybolovlev stated during trial, “It’s important for the art market to be more transparent . . . clients don’t stand a chance.” Sotheby’s countered by putting the onus on buyers to do their own homework. The auction house reminded the jury that Rybolovlev is a successful businessman who has conducted major business deals and who should be familiar with due diligence. Sotheby’s stated, “Throughout Mr. Rybolovlev’s testimony, it was patently clear that, as a self-made billionaire with a diverse and expansive network of interests, none of the care and attention to detail he attended to his businesses were given to his art transactions.” Unfortunately, this is common for art collectors—many do not complete sufficient due diligence.

WHAT COULD RYBOLOVLEV HAVE DONE TO PROTECT HIMSELF?

The art market is unusual in that some people pay vast amounts of money on acquisitions without doing much due diligence. This may be because people feel comfortable when operating in such a rarefied world. Some collectors get swept up in the glamor of the art world and act irrationally, forgetting that art world scams occur.

While the art market is not quite ready for full transparency, there are steps collectors can take to protect themselves against predatory practices or fraud. Collectors should have written agreements specifying what a broker/advisor will make on a deal, as well as language that prohibits that advisor/dealer from holding an ownership interest in a work (such as buying it beforehand to flip it, or purchase the work for a company in which he or she has an ownership interest). There are contractual tools used to reduce the risk of deceptive and misleading business practices. An agreement may require parties to disclose information about whether an advisor has an ownership interest in a work. It could also set forth clear information about kick-backs and payments being made to an advisor so that the advisor does not double-dip or play multiple roles in a transaction. To the best of our knowledge, Rybolovlev did not have any of these legal tools in place. If he had them, it would have been easier to sue Bouvier for breach of contract – something easier to prove than fraud.

In addition, collectors should ask for more information and require certain disclosures about parties’ interests. If Rybolovlev had an attorney for the transactions with Bouvier, the attorneys should have required Bouvier to disclose his relationship with sellers and other potential middlemen. If Bouvier lied in these documents, then fraud claims would have been easier to prove.

WHAT IS THE SIGNIFICANCE OF THE CASE?

The case against Sotheby’s was interesting for a number of reasons. First, it reveals a great deal about the art and antiquities market. There are many buyers engaging in transactions with little to no due diligence, whether their acquisitions are relatively inexpensive or in the tens of millions of dollars. Second, because of the lack of due diligence and transparency, some parties misrepresent or decline to provide material information about transactions, including the identities of parties, the actual sale prices, as well as commissions and kick-backs. Without this information, it is easy for parties to engage in fraud, including financial schemes, forgery conspiracies, and the sale of stolen art and looted antiquities. Finally, the case has provided the public with insights about the high-end art and antiquities market, including a glimpse into the business practices and private relationships of high-end dealers, auction houses, and collectors.

The amount of attention given to this dispute will hopefully encourage art market participants to evaluate their business practices. Although Sotheby’s was not found guilty, the auction house dealt with negative publicity, faced questions about their internal policies, and paid a hefty bill for its legal defense. It would be interesting to learn whether the trial led to Sotheby’s amending any of its internal policies and business practices.

Today, the art and antiquities market is largely unregulated, particularly because major deals are conducted behind closed doors with little oversight. This litigation is a great opportunity for the court to provide guidance to protect parties to these sales and clarify what information a dealer/advisor must provide to his or her clients.

Although Rybolovlev was not successful in this legal action, his lawyer stated that one of his client’s aims was met because the case shined “a light on the lack of transparency that plagues the art market.” He also stated, “That secrecy made it difficult to prove a complex aiding and abetting fraud case. This verdict only highlights the need for reforms, which must be made outside the courtroom.”